Money Market Fund

Providing stability

Fund Objective

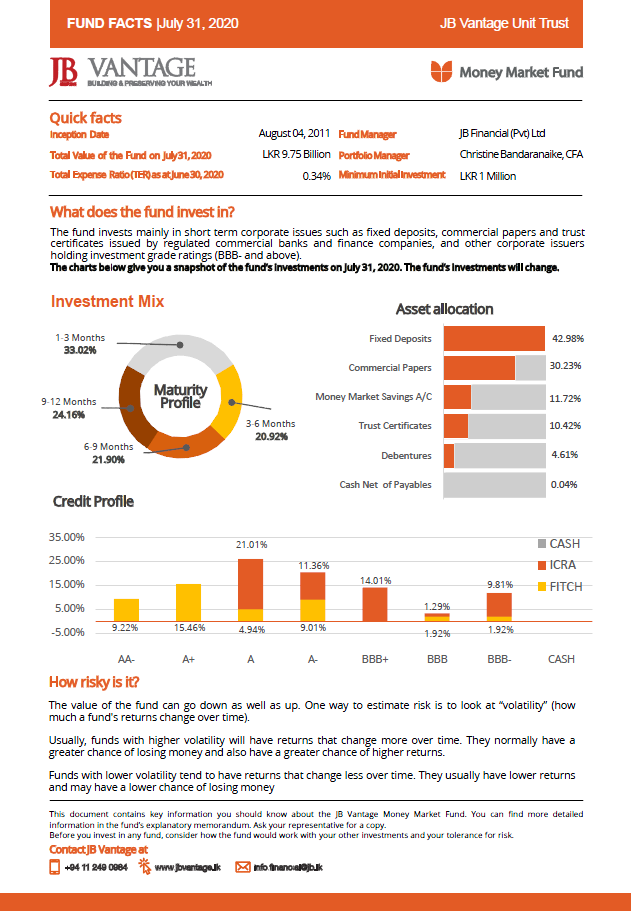

The fundamental investment objective of this Fund is to earn a high rate of interest income while at the same time preserving capital and maintaining liquidity by investing in money market securities of companies rated “investment grade” (BBB- and higher) maturing in less than one year.

Intended For

The Fund is suitable for short term investors looking for competitive rates of interest and minimum capital risk as well as those investors uncertain of their time horizon. It is also appropriate for working capital management or to earn interest while waiting to pay out a large outflow.

Why Invest?

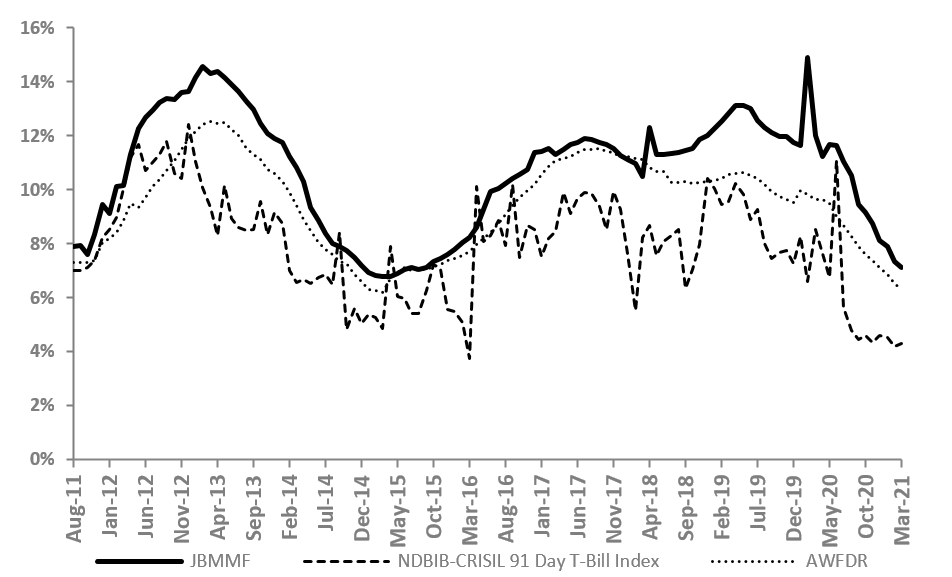

Competitive returns above the average bank rate. The large proportion of high-quality corporate investments enables this fund generally to deliver higher short-term results relative to its peers.

Fund Performance

Performance Since Inception (Annualized)

| 1 Month | 3 Months | 6 Months | YTD | 1 Year | SI* | TER** |

| 15.20% | 16.05% | 17.75% | 15.20% | 23.52% | 12.52% | 0.61% |

Past performance is not indicative of future performance

Performance as of January 31, 2024

Returns shown are after all taxes, fees and expenses and based on NAV

All returns shown are annualized

*SI – Since Inception

** TER as of 31st December 2022

For Fund reports, please login.

For Fund reports, please login.

– GIPS pooled fund reports are provided at year-end as required by GIPS 2020.

– Quarterly updates of GIPS pooled fund reports are available upon request.

Meet the Fund Manager

Christine Bandaranaike has worked in private and institutional fund management since 1996. She joined JB Financial in 2011 to set up the firm’s pooled asset management program. At JB Financial, Christine functions in the capacity of Chief Executive Officer and as portfolio manager for the JB Vantage Money Market Fund & Short Term Gilt Fund.

Christine began her career with TD Bank Financial Group of Canada in mutual funds and retail treasury, moving onto private asset management. In Sri Lanka, she worked at CitiNational Investment Bank delivering structured finance solutions to clients. She then worked as a consultant, advising institutional investors on setting internal investment policy.

Christine trained as an economist and holds an MA from the University of Toronto and a BA (Hons) Economics from the University of Western Ontario. She is a member of the Institute of Chartered Financial Analysts (Charlottesville, USA) and a CFA charterholder since 1999.